Falling Bankruptcy Numbers – Is this the era for “Doing Deals” to solve financial distress..?

You may have heard that insolvency numbers were at record lows during and following the Covid Pandemic. Even now (as of February 2023) the numbers remain low, but some pick up or return to normality is expected by most in the industry during 2023, as high debt, high inflation and raising interest rates all start to have their expected impacts.

One of the core reasons for these declines was the various measures instituted by Government during the Pandemic, and the hands-off approach adopted by the ATO. Obviously, these measures were aimed at ensuring business survival during the pandemic, and it seems, they were largely successful, albeit data on businesses that just folded or deregistered without a formal insolvency is scant (refer the many stories on so called “zombie businesses”).

One issue that has garnered less attention is with relation to personal insolvencies (as distinct from "corporate" or company related insolvency). The statistics show that personal insolvency numbers have been on a steady decline for at least the last 15 years! Recently released statistics note that the 9,545 personal insolvencies in the 2021-22 FY were well below half the 10-year average of 25,300 insolvencies annually!

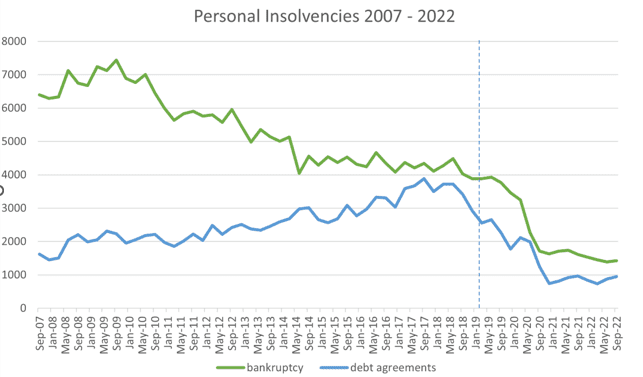

This chart clearly shows the downtrend from statistics recently released by AFSA - the government regulator of personal insolvency:

A "personal insolvency" can take on of several forms - Bankruptcy, a Part X arrangement, or a Part IX Debt Agreement. It is handy to start with a brief discussion of the difference between these regimes...

Bankruptcy is the protection afforded to both business people and to consumers who are “insolvent”, that is, they are personally unable to pay their debts as and when they fall due. A bankruptcy can be voluntary (i.e. the person in distress files forms and declares their own bankruptcy) or forced (i.e. someone who is owed money by the individual takes legal action and the Court orders the bankruptcy). Upon bankruptcy all of the persons divisible assets become controlled by a Bankruptcy Trustee and are realized (with several limited exceptions) for the benefit of the creditors. Once a person is bankrupt creditors can longer chase or deal with the bankrupt and at the end of the bankruptcy period (generally 3 years) all of the insolvent persons debts (again with just a few exceptions) are “wiped” – by law.

An arrangement under Part X of the Bankruptcy Act, is a regime aimed at avoiding bankruptcy by offering an individuals creditors an improved return as compared to what they may get in a formal bankruptcy. This may be offering a return of a certain amount of cents in the dollar via instalments over time, or some other injection of funds (e.g. a loan from a family member) to provide a better outcome than creditors are likely to receive in a usual bankruptcy scenario. A Part X can be considered a formal mechanism for “doing a deal” with your creditors.

A Debt Agreement (or Part IX arrangement) is a simplified regime particularly aimed at consumer level debts, whereby an individual meeting certain criteria (primarily having liabilities of less than approximately $128,000, assets under $257,000 and after tax income of less than $96,000 PA) enters an arrangement with their creditors and agrees to pay back an agreed sum to all of their creditors by payments over time.

As can be seen from the chart above, numbers for both Bankruptcies and Debt Agreements are at close to the lowest levels we have seen in 15 years, and in the case of Bankruptcies, numbers were certainly declining well before the Pandemic.

It has been noted that a personal insolvency roundtable will be occurring during March 2023, where many of these issues and the potential for significant personal insolvency reforms will be thrashed out (possibly including the often debated shortening of the bankruptcy period (in certain cases), to potentially 12 months (or even less…).

What can we read into this…?

Certainly Covid hand-outs, stimulus measures and record low interest rates had the desired effect of putting money into consumer pockets and proving a buffer from financial distress;

Given the declining formal insolvency numbers, you can only assume that more informal arrangements are occurring to pay off or compromise debts;

Creditors won’t always want to spend the increasing cost of legal proceedings to pursue a person to bankruptcy through the Court process (it will usually cost the creditor in the region of $10,000 to make someone bankrupt);

Creditors have possibly become more commercial and pragmatic about their resourcing and pursuit of delinquent debts.

So what does this mean for someone currently experiencing financial distress…?

Individuals with excess debt, should really consider negotiating with creditors. You can call creditors yourself, or approach professionals at this, for assistance…

If you haven’t heard from someone you owe money to (particularly the ATO for example) be wary of just assuming you will not be chased for the debt and just continue on your merry way… If you subsequently acquire assets or build up a business or equity in a property, this could become exposed to those creditors in the future.

Obviously, consolidation of credit cards and loans is always worth considering to help manage arrears, high default interest rates, and those creditors pushing harder than others (but make sure to close off the old credit cards to avoid the temptation);

Part X arrangements may be coming into their own! These are a formal “deal” with your creditors, they bind everyone, yet provide more flexibility in terms of return expectations, and don’t have the restrictive eligibility limitations of a Part IX Debt Agreement. Robson Cotter are specialists at Part X arrangements.

What should you do next…?

As always, professional advice is highly recommended, to review your personal circumstances and help plan the best approach.

You can always call the National Debt Help Line (1800 007 007), or other consumer financial advice lines.

Otherwise, call us! We offer free, no obligation consultations to help deal with unmanageable debt.